Exploring Stochastic Oscillator-how to use Stochastic Oscillator

Exploring Stochastic Oscillator: A Guide to Utilizing Technical Analysis

In the subsequent segment of our series on technical analysis and indicators, we will delve into another momentum oscillator known as the Stochastic Oscillator. This particular indicator gauges the velocity and momentum of an instrument’s price movement while identifying trends and their shifts.

George Lane, the developer of the Stochastic Oscillator in the 1950s, proposed that the change in momentum or speed of an instrument’s price movement occurs before the price itself changes direction. Lane emphasized that the Stochastic Oscillator does not track the price directly, nor does it consider volume or other factors. Instead, it focuses solely on the speed or momentum of the price—the strength of the prevailing trend. The Stochastic Oscillator, in its basic form, compares an instrument’s closing price to its highest and lowest prices over a given period, typically 14 days (or other timeframes, depending on the trader’s chart preferences).

Understanding the Stochastic Oscillator:

The underlying idea of this indicator lies in the observation that in an uptrend, the price of an instrument tends to close near its high, while in a downtrend, it closes near its low. However, when prices deviate further from these extremes, it indicates a weakening momentum and suggests a possible trend reversal.

Similar to other oscillators (such as the recently discussed RSI), the Stochastic Oscillator is displayed in a separate chart window, with values ranging between 0 and 100. While the RSI considers all closing prices within a given period, the Stochastic Oscillator focuses solely on the current price in relation to the highest and lowest prices.

Calculation: The Stochastic Oscillator also exhibits two lines. However, unlike the RSI, one line represents the indicator’s value (%K), while the other represents its three-day moving average (%D). The formula for calculating the indicator’s value is as follows:

%K = 100[(C – L14) / (H14 – L14)]

where:

C = the latest closing price L14 = the lowest low over the past 14 periods H14 = the highest high over the past 14 periods %D = a simple moving average with a period of 3

The default values of the indicator often set the deceleration or smoothing %K value to 3, reducing sensitivity to price changes.

Using a 14-period calculation is generally considered long enough to capture relevant information while still being responsive to market changes. However, traders operating on shorter timeframes may opt for a shorter period, leading to more frequent entry signals from the indicator.

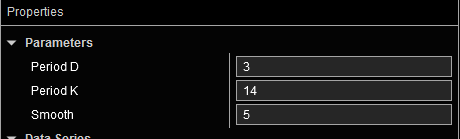

I use following parameters:

Utilizing the Indicator:

Similar to the RSI, the primary application of the Stochastic Oscillator is to indicate overbought or oversold conditions in the market. It signals that an uptrend or downtrend in the instrument may be approaching its end. When the indicator surpasses the 80-point level, it suggests overbought market conditions and a drop below 80 signals a potential selling opportunity. Conversely, when the indicator falls below the 20-point level, it indicates oversold conditions and a rise above 20 signifies a possible buying opportunity.

However, a drawback of this indicator, as with other overbought/oversold oscillators, is that in robust trends or highly volatile markets, prices may frequently reach these extreme levels, leading to false signals. One possible solution is adjusting the levels to 15 and 85, although this may result in missed opportunities. Another approach involves trading only signals that align with the prevailing trend.

Divergence:

Divergence is a popular technique used with the Stochastic Oscillator (and many other oscillators). A bullish divergence occurs when the instrument’s price establishes lower lows while the Stochastic Oscillator forms higher lows, indicating a potential weakening of the downward momentum and a possible reversal. Conversely, a bearish divergence occurs when the price achieves higher highs while the indicator generates lower highs, suggesting a loss of upward momentum and a potential trend reversal. However, it’s crucial to confirm such signals with actual reversals in the instrument’s price.

Crossover:

Crossover takes place when both indicator lines (%K and %D) cross above the oversold level or below the overbought level. A sell signal is triggered when the %K line crosses the %D line above the overbought level, while a buy signal occurs when the %K line crosses the %D line below the oversold level.

Other Applications:

In addition to the 20 and 80 lines, some traders frequently employ the 50-point level in the Stochastic Oscillator as a strong entry signal. When the %K line crosses below the 50-point level, it can be a robust sell signal, and when it crosses above the 50-point level, it can be a compelling buy signal.

As with any technical analysis tool, it’s important not to rely solely on the Stochastic Oscillator for generating buy and sell signals. Combining it with other indicators can enhance its accuracy and provide higher-quality entry points. The Stochastic Oscillator can be used alongside moving averages, trend lines, chart formations, and other technical analysis tools to achieve a well-rounded trading approach.