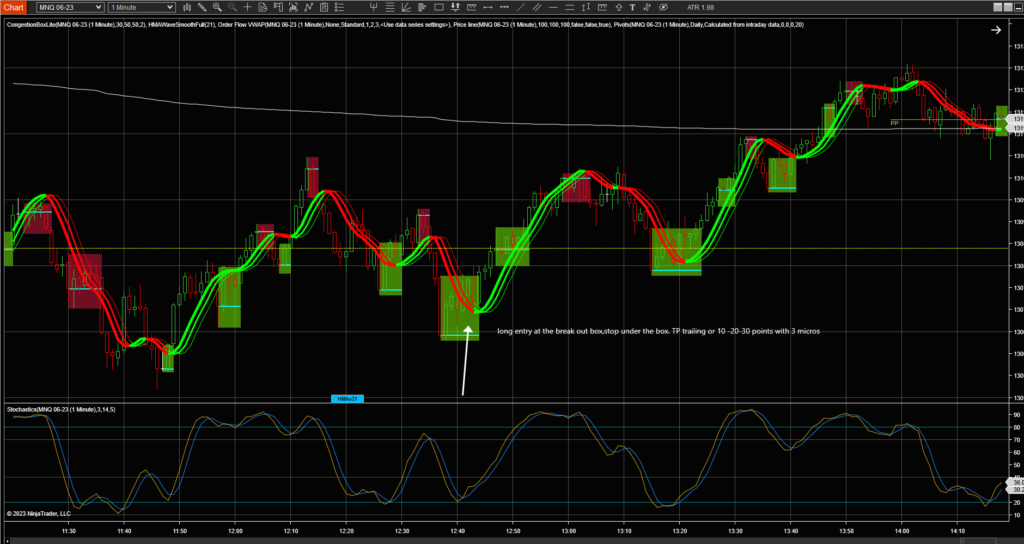

A Scalping Strategy For Prop Traders but not only- using HMA Wave, Congestion Box, and Stochastic Indicator

THE SECRET: Take small profits or trail it. Do NOT become greedy

Are you looking for a high-probability scalping strategy that can help you take advantage of short-term price movements in the market? If so, then this article is for you! In this article, we will explore a scalping strategy that combines the HMA Wave indicator, Congestion box, and Stochastic indicator to identify potential trading opportunities.

The HMA (Hull Moving Average) Wave indicator is a powerful trend-following indicator that provides visual cues for identifying trend direction and momentum. It consists of three lines that change colour based on the direction of the trend, making it easy to identify trend changes. The congestion box is a price range where the price moves within a relatively tight range, indicating a period of consolidation or indecision in the market. It can act as a potential setup for a breakout or a breakdown, providing trading opportunities. Lastly, the Stochastic indicator is a popular momentum oscillator that measures the strength and speed of price movements. It consists of two lines oscillating between 0 and 100, indicating overbought and oversold conditions in the market.

Here’s how the scalping strategy using HMA Wave, congestion box, and Stochastic indicator works:

Step 1: Identify the Trend with HMA Wave Indicator

HMA WaveSmooth Add-on

Send download link to:

Apply the HMA Wave indicator to your trading chart. The three lines of the HMA Wave indicator will change colour based on the direction of the trend: green for an uptrend, and red for a downtrend.

Look for a clear and strong trend direction indicated by consistent colour changes in the HMA Wave indicator.

Step 2: Identify the Congestion Box

Keep an eye out for a period of congestion or consolidation in the market where the price moves within a relatively tight range.

Draw horizontal lines to mark the upper and lower boundaries of the congestion box.

This indicator will do this for you

CongestionBoxLite

Send download link to:

Step 3: Wait for Stochastic Confirmation I use the following parameters:

Period D=3

Period k=14

Smooth=5

Monitor the Stochastic indicator for oversold conditions (below 10) for long trades or overbought conditions (above 90) for short trades.

Wait for the Stochastic indicator to confirm the oversold or overbought condition before proceeding to the next step and to start hooking up or down for long/short trades

Step 4: Confirm with HMA Wave Indicator

Look for a change in the colour of the HMA Wave indicator to green for long trades or red for short trades.

Wait for both the Stochastic confirmation and HMA Wave colour change before entering a trade.

Step 5: Enter the Trade

When the Stochastic indicator confirms oversold conditions (below 10) and the congestion box appears, and the HMA Wave indicator changes colour to green, consider entering a long trade.

When the Stochastic indicator confirms overbought conditions (above 90) and the congestion box appears, and the HMA Wave indicator changes colour to red, consider entering a short trade.

Step 6: Set Stop Loss and Take Profit

Set a tight stop loss below the congestion box for long trades or above the congestion box for short trades to manage risk.

Set a target profit level based on your desired risk-reward ratio or use a trailing stop to lock in profits as the trade progresses.

Step 7: Manage the Trade

Monitor the trade closely, adjust stop loss, and take profit levels as needed.

Consider closing the trade if the price reverses or if the trade does not go as planned.

In conclusion, the scalping strategy using HMA Wave, congestion box, and Stochastic indicator can provide potential trading opportunities in short-term timeframes. However, as with any trading strategy, it’s important to practice proper risk management, use proper position sizing, and conduct thorough analysis before entering a trade.

It’s also crucial to backtest and forward-test the strategy on a demo account before using it with real money to gain confidence in its effectiveness.

Additionally, keep in mind that no trading strategy is foolproof, and there will be losing trades. It’s important to have realistic expectations and not to solely rely on any single strategy for trading success. It’s also recommended to stay updated with market news, economic events, and other factors that may impact the price movements in the market.

Remember to always trade within your risk tolerance and never risk more than you can afford to lose. It’s also advisable to consult with a qualified financial professional or seek professional advice if you are unsure about any aspect of your trading strategy or overall financial situation.

In conclusion, the scalping strategy using HMA Wave, congestion box, and Stochastic indicator can be a potentially effective approach to scalp NQ /ES/YM futures or other similar markets. However, it’s important to thoroughly understand the strategy, practice proper risk management, and continually evaluate and adapt your approach as needed. Happy trading!