Market Structure

In this article, we will understand the following pointers.

1. What is the Market Structure in Trading?

2. Principles of Market Structure

3. Elements of the Market Structure

What is Market Structure in Trading?

– Market structure gives us bias for trading opportunities. In the bull market, we always look to buy dips

– Range market we look for buy low sell high

Principles of Market Structure (here good indicator )

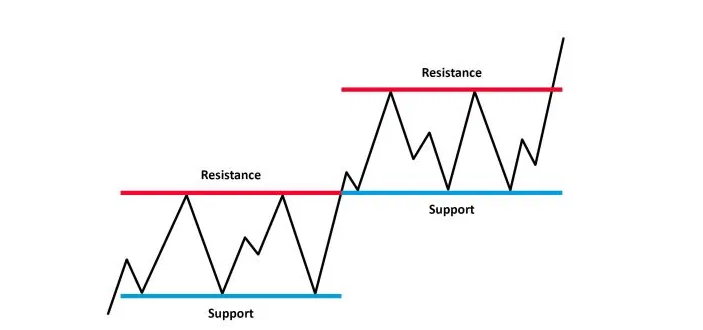

Price moves within a structure of support and resistance.(FVG plus indicator here )

A breakout of the structure of support or resistance will lead to price movement in the next area of support or resistance.

A breakout of the support/resistance will lead the price into the next area of S/R

Support and Resistance Levels

The battle between buyers (demand) and sellers (supply) is the key to price movements. In technical analysis, it creates what we see as resistance and support levels.

When the price of an instrument reaches a level where supply overtakes demand, a rise in price will hit the ceiling and begin to fall. A high in price is left, and resistance is created.

In Simple words supports are a price level that the stock will not fall below and resistance is a price level that the stock can’t seem to rise above. The longer these levels hold, the more they become stabilized for an eventual breakout or breakdown.

Elements of the Market structure

The market structure consists of: Phases and Trend

Phases: How does the market really work?

All financial markets work on the universal law of Supply and Demand.

The Demand – The higher the price of an item, the less the demand (buyers don’t want to buy at a higher price) and the lower the price, the higher the demand (buyers want to buy at a low price)

The Supply – The higher the price of an item, the higher the supply (sellers want to sell at a higher price) and the lower the price, the lower the supply (sellers don’t want to supply at a lower price

So prices go up to find sellers and then go down to find buyers

Let’s think from the perspective of smart money

What is smart money?

– Smart money is professional money, hedge funds and institution’s

– If you want to be a successful trader you have to understand where these smart money place themselves and where their orders are

– If you don’t know this you might get trapped by smart money

The price goes through 4 Phases

1. ACCUMULATION

2. UPTREND

3. DISTRIBUTION

4. DOWNTREND

ACCUMULATION

Accumulation means removed from the floating supply of stock by buying

Demand coming in to gradually overcome and absorb the supply and to support the stock at this level

How smart money do that? they buy as much of the stock as possible, without significantly putting the price up against their own buying until there are few, or no more shares available at the price level they have been buying at

Accumulation generally takes place within a well-defined congestion area, where the stock appears to have no interest to either move up or move down. The smart money ensures that the stock is contained below a certain upper level which is the supply area. At the same time, the smart money also supports the prices above a certain lower line which is the support area.

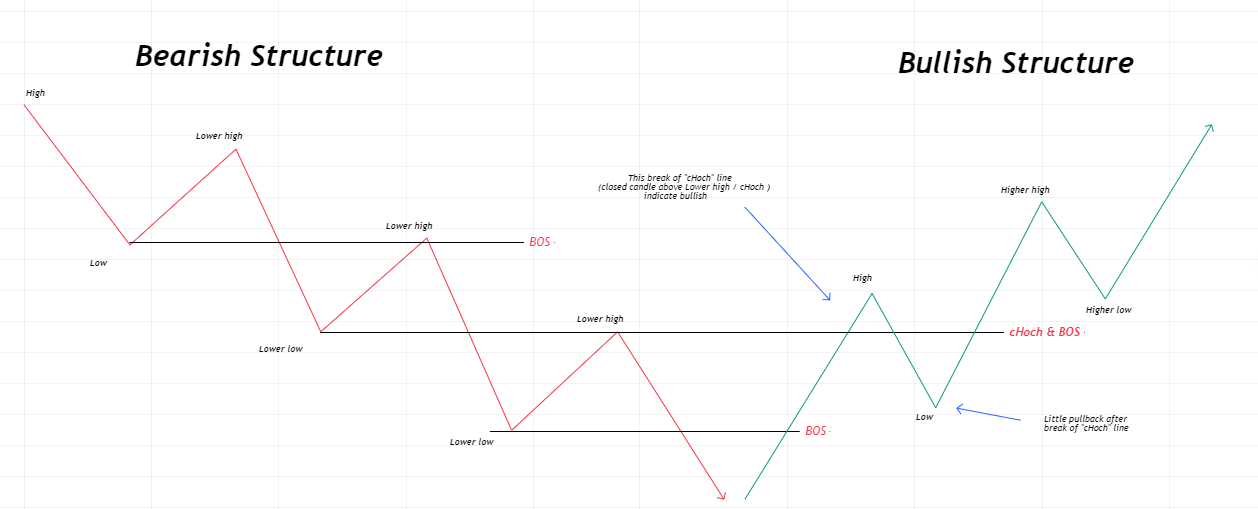

How does the trend change?

– Stopping action(stopping the downtrend or uptrend)

– Change of character(strength of trend change from bearish to bullish or from bullish to bearish)

– Testing of supply(testing supply whether present or not)

– Mark up(if no supply is found in testing action)

There are many other patterns that signify accumulation. Some of them are

– rounding bottoms,

– reverse head and shoulder and

– double bottoms patterns

– triple bottom pattern

UPTREND

Once the supply observes by smart money. When general market conditions appear favourable, the Smart Money can then mark up the price of the stock At some time in the future

First, the market breaks out from the end of the accumulation phase, moving higher steadily, with average volume. There is no rush as the insiders have bought at wholesale prices and now want to maximize profits by building bullish momentum slowly, as the bulk of the distribution phase will be done at the top of the trend, and at the highest prices possible. Again, given the chance, we would do the same

Accumulation is nothing but a sideways / Range bound market activity that happens after an extended downtrend. This is the phase where smart money traders and big institutional players try to accumulate or acquire positions without moving the prices too much to the upside.

Accumulation means Big Players are buying the stock after a large downfall without moving the prices too much.

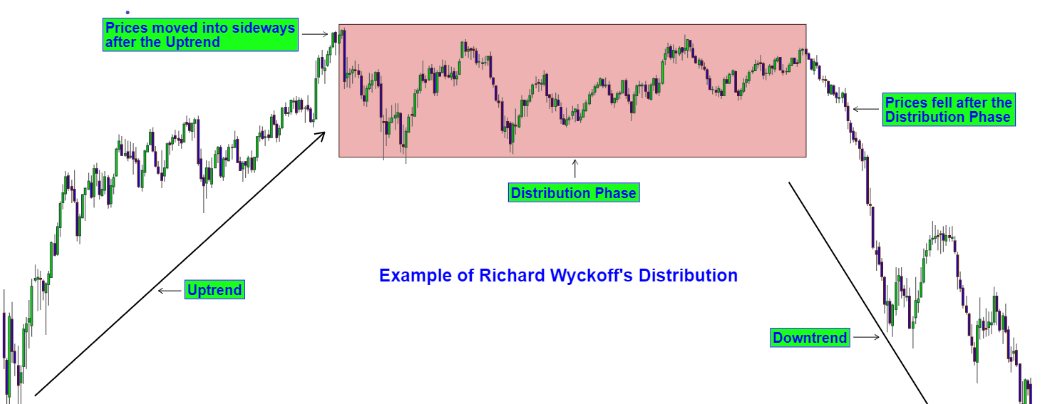

DISTRIBUTION and DOWNTREND

The process described is a typical cycle in the stock market, where smart money (experienced investors) accumulate stocks during a period of low prices, and then sell them off to uninformed traders and investors during a period of high prices, known as the distribution phase. After the distribution phase is complete, the smart money then begins to mark down the price of the stock, leading to a downtrend in the market. This cycle of accumulation, distribution, and downtrend is a common occurrence in the stock market and is driven by the actions of smart money and their ability to take advantage of market trends.

Distribution is the exact opposite of Accumulation. It’s a sideways/Range bound market activity that happens after an extended Uptrend. This is the phase where smart money traders and big institutional players try to distribute or sell off their positions without moving the prices too much to the downside.

Smart Money traders are buying in Accumulation Phase and selling in Distribution Phase. As a small-scale trader, you should follow the footprints and do the same.

This cycle of accumulation and distribution is then repeated endlessly, and across all the time frames. Some may be major moves, and others minor, but they happen every day and in every market

Market Trends

Market trends are the general direction or movement of prices of stocks, commodities, or other financial assets over a period of time. These trends can be bullish (upward), bearish (downward), or sideways (neutral).

A bullish trend is a market condition in which prices of financial assets are generally rising over an extended period of time. This can occur due to factors such as strong economic growth, positive news or earnings reports, or an increase in investor confidence. During a bullish trend, investors may be more willing to buy assets as they anticipate further price increases.

A bearish trend, on the other hand, is a market condition in which prices of financial assets are generally falling over an extended period of time. This can occur due to factors such as an economic slowdown, negative news or earnings reports, or a decrease in investor confidence. During a bearish trend, investors may be more inclined to sell assets as they anticipate further price decreases.

A sideways trend, also known as a range-bound market, occurs when prices of financial assets are generally moving within a narrow range with no clear trend in either direction. This can occur due to a lack of significant market-moving news or events or due to uncertainty among investors. During a sideways trend, investors may adopt a wait-and-see approach, as there may be little indication of future price movements.

Determining the market trend

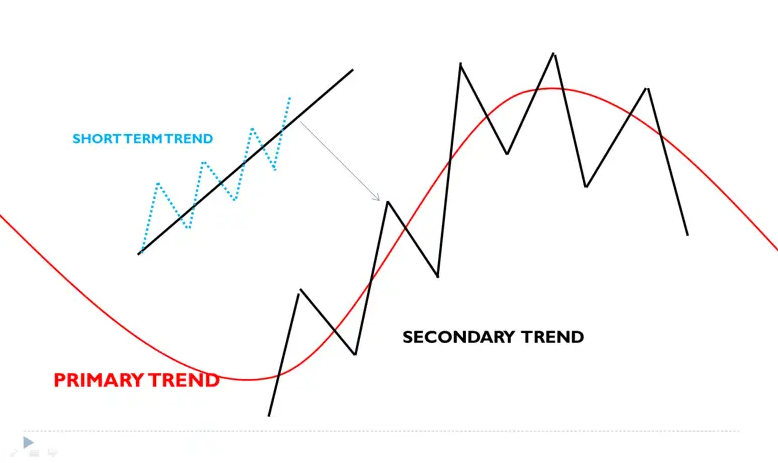

According to Dow Theory, the market has three trends

Primary trend: In Dow Theory, the primary trend is also considered a major trend in the market. It has a long-term impact

Secondary trend: Dow calls a correction in the primary trend as a secondary trend. In a bullish market, the secondary trend will be a downward movement and in a bearish market, it will be a rally.

SHORT TERM trend: The Minor Trend is a corrective move within the secondary trend

Which time frame trend is best?

– It depends on what time frame you are looking at.

– Larger Timeframes establish and dominate the trend.

– If we are looking at the daily time frame and the price is making higher highs and higher lows we are in the bull market

– But if we are looking at a retracement of that bull move in 30 minutes time frame we might be in a short-term bear market even though the overall market is bullish