Introduction

Trading in financial markets can be a complex and ever-changing endeavor. Traders and investors are constantly on the lookout for patterns, trends, and historical events that can provide valuable insights into market behavior. Two intriguing phenomena in the world of trading are “seasonality” and the “Christmas Rally.” Additionally, we’ll delve into one of the most infamous events in financial history: Black Monday. In this article, we’ll explore these concepts, providing a deeper understanding of how they impact trading markets.

Understanding Seasonality

Seasonality refers to the tendency of financial markets to exhibit recurring patterns or trends during specific times of the year. These patterns can be attributed to various factors, including weather, holidays, and cultural practices. Understanding seasonality can be a powerful tool for traders and investors looking to anticipate market movements.

One of the most well-known instances of seasonality is the “Santa Claus Rally.” This phenomenon occurs towards the end of the year, often during the week between Christmas and New Year’s. Historically, this period has seen stock markets experience a boost in performance, attributed to increased consumer spending and optimism as the holiday season approaches. Traders and investors sometimes prepare for the Christmas Rally by entering or adjusting positions to take advantage of this upward trend.

Seasonality and Its Complexities

Seasonality in trading markets is a fascinating phenomenon. It is not limited to the Christmas Rally but extends to various other aspects of trading. Some common examples of seasonality include the “January Effect” and the “Sell in May and Go Away” strategy.

1. January Effect: This concept suggests that stocks tend to perform well in January, following a decline at the end of the year. This could be attributed to tax considerations, similar to the Christmas Rally, as investors may engage in tax-related portfolio adjustments at the beginning of the year.

2. Sell in May and Go Away: This strategy recommends selling stocks in May and staying out of the market until November. The rationale is that markets tend to be less favorable during the summer months. While this approach has historical backing, it’s essential to remember that past performance is not always indicative of future results, and market dynamics can change.

The Christmas Rally

The Christmas Rally is characterized by increased buying activity and positive sentiment in the market. There are several reasons for this rally:

1. Tax-Loss Harvesting: Towards the end of the year, investors may engage in tax-loss harvesting, which involves selling underperforming assets to offset gains elsewhere in their portfolio. This process can result in capital freed up for re-investment, contributing to the rally.

2. Fund Rebalancing: Portfolio managers may rebalance their holdings to meet specific asset allocation targets before year-end, leading to increased buying.

3. Positive Sentiment: The festive atmosphere and optimism during the holiday season can boost investor confidence, leading to increased trading activity.

It’s important to note that while the Christmas Rally is a recurring phenomenon, it is not a guaranteed market event. It’s just one piece of the puzzle when considering trading decisions.

The Intricacies of the Christmas Rally

The Christmas Rally, a subset of seasonality, is a period when traders anticipate increased market activity. However, it is crucial to note that not every year follows the same pattern. Various factors can influence its strength and timing, such as economic conditions, global events, and consumer sentiment.

For example, during economic downturns or amid significant global uncertainties, the Christmas Rally might be less pronounced. The market’s performance is a reflection of the broader economic and geopolitical landscape, and the rally’s strength can vary considerably.

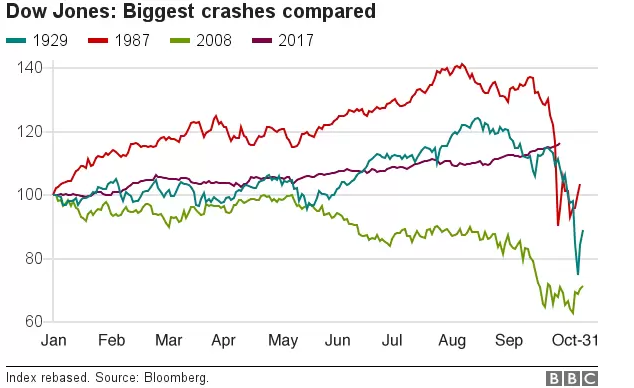

The Infamous Black Monday Event

While seasonality and the Christmas Rally are examples of positive market phenomena, the history of financial markets also includes dark chapters. One such chapter is Black Monday, which occurred on October 19, 1987. Black Monday is widely recognized as one of the most significant single-day stock market crashes in history.

The market decline on Black Monday was sharp and sudden. The Dow Jones Industrial Average plummeted by 508 points, representing a 22% drop in a single day. Several factors contributed to the crash:

1. Overvaluation: Leading up to the event, stock prices had risen dramatically, creating a sense of overvaluation in the market.

2. Program Trading: The increasing use of computerized program trading exacerbated the selling pressure as computers executed a wave of automated sell orders.

3. Panic Selling: As the market started to decline, panic selling set in, causing a cascading effect.

The crash was a major shock to the financial world, and it led to regulatory changes, including the introduction of “circuit breakers” to halt trading during extreme market moves. Lessons from Black Monday are still relevant today, emphasizing the importance of risk management and diversification in trading and investing.

Learning from Black Monday: A Cautionary Tale

The Black Monday event of October 19, 1987, was a stark reminder of the unpredictable nature of financial markets. Despite the regulatory changes introduced to mitigate such crashes, it’s crucial for traders and investors to grasp the lessons it offers.

1. Risk Management: Black Monday underscores the importance of robust risk management strategies. Traders should set stop-loss orders to limit potential losses and have a well-defined exit plan in place.

2. Diversification: A well-diversified portfolio is a key defense against extreme market volatility. Spreading investments across different asset classes can help mitigate the impact of a market crash in one specific area.

3. Continuous Learning: The financial landscape is continually evolving. Traders and investors need to stay informed, adapt to changing market conditions, and continuously learn from past events and market dynamics.

Conclusion

Seasonality, the Christmas Rally, and Black Monday are all part of the rich tapestry of trading markets. While seasonality can provide valuable insights into market behavior, traders and investors must approach these patterns with caution, as past performance is not indicative of future results. Additionally, understanding historical events like Black Monday serves as a stark reminder of the inherent risks in financial markets.

Successful traders and investors not only consider historical patterns but also stay informed, manage risk, and diversify their portfolios to navigate the ever-changing world of trading. These lessons from history help us make more informed decisions in the exciting and sometimes tumultuous realm of financial markets.