Overview of PTZ_ScalpTradeV1

The PTZ_ScalpTraderV1 indicator works by plotting three moving averages on your chart: two fast-moving averages and one trend-moving average. It also highlights the area between the two fast-moving averages as a “tunnel.” The indicator generates buy and sell signals based on the relationship between the price and these moving averages, helping traders identify potential trading opportunities in trending markets.

PTZ_ScalpTraderV1

Send download link to:

By default, the indicator has the values I use. The best time frame I found to be is 3 Min charts. Works well also on other charts, like Renko, Tick,etc

Avoid taking signals long if the cloud is hiding down, or short when the cloud still hiding up.

Key Components of the Indicator

1. Fast Moving Averages (Fast MA 1 & Fast MA 2):

– These are shorter-term moving averages that track the recent price action.

– The area between these two moving averages forms the “tunnel,” which acts as a buffer zone to filter out false signals.

2. Trend Moving Average:

– This longer-term moving average helps identify the overall trend direction. The price position relative to this moving average influences whether the indicator generates a buy or sell signal.

3. Buy and Sell Arrows:

– The indicator draws arrows on the chart to signal potential buy and sell opportunities.

– Green arrows indicate a buy signal, while red arrows indicate a sell signal.

– These signals are triggered based on the conditions discussed below.

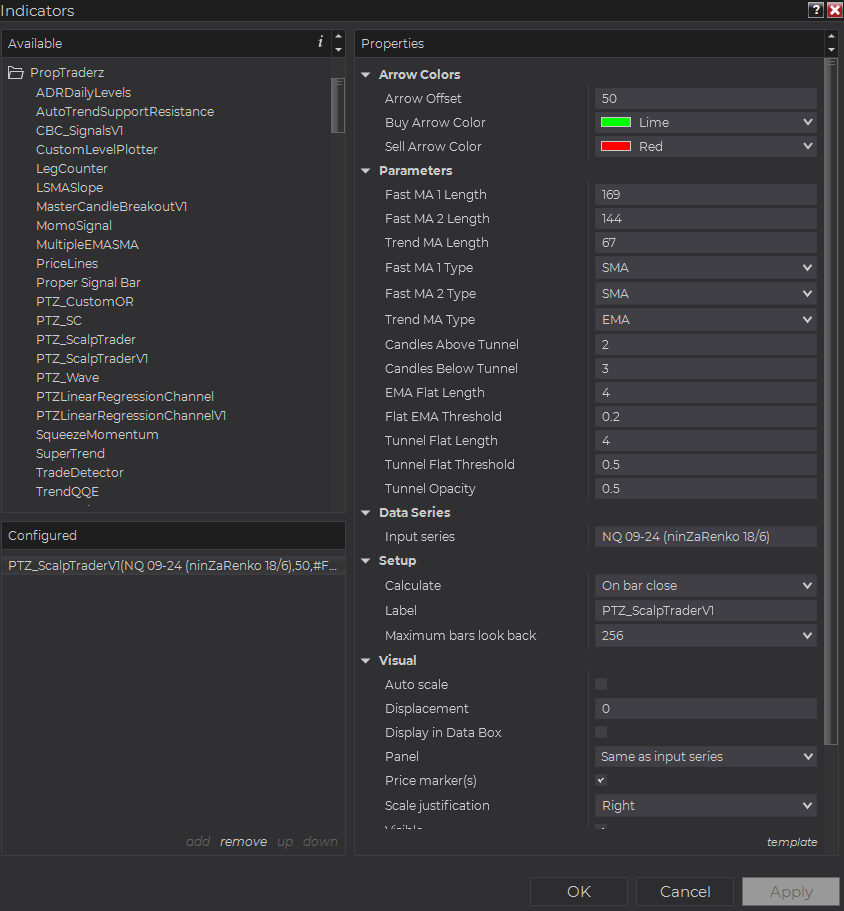

Understanding the Parameters:

– Fast MA 1 Length & Fast MA 2 Length: Define the lengths of the fast-moving averages.

– Trend MA Length: Specifies the length of the trend-moving average.

– Candles Above/Below Tunnel: Determines the number of consecutive candles required above or below the tunnel to trigger a signal.

– EMA Flat Length & Flat Threshold: Helps identify when the trend-moving average is flat, signaling a non-trending market.

Buy and Sell Signals:

– Buy Signal: The indicator generates a buy signal (green arrow) when the price closes above both fast-moving averages, the trend MA is rising, and a specified number of candles have closed above the tunnel.

– Sell Signal: The indicator generates a sell signal (red arrow) when the price closes below both fast-moving averages, the trend MA is falling, and a specified number of candles have closed below the tunnel.

Interpreting the Flat Threshold

The Flat Threshold is a key parameter that helps filter out false signals during non-trending or flat market conditions.

1. What is the Flat Threshold?

The flat threshold defines how “flat” the trend-moving average is. If the average change in the trend MA over a specified number of bars is below this threshold, the market is considered flat.

2. Why is the Flat Threshold Important?

In flat markets, the price tends to oscillate without a clear direction, leading to potential whipsaws and false signals. The flat threshold helps the indicator identify these conditions and refrain from generating signals in such environments.

3. How to Set the Flat Threshold?

The default flat threshold is set at 0.5, which works well for most markets.

If the indicator is too sensitive (generating too many signals), consider increasing the threshold. Conversely, if it misses potential trades, you may want to lower the threshold.

4. EMA Flat Length:

This parameter works in conjunction with the flat threshold. It specifies the number of bars over which the flatness of the trend MA is calculated.

A higher value smooths out the trend MA more but may result in delayed signals, while a lower value makes the indicator more responsive.

Customization Options

The PTZ_ScalpTraderV1 indicator offers several customization options to tailor it to your trading style:

Arrow Offset: Adjust the vertical placement of the buy/sell arrows on the chart.

Arrow Colors: Choose your preferred colors for buy-and-sell arrows.

Tunnel Opacity: Control the transparency of the tunnel area between the two fast-moving averages.

The PTZ_ScalpTraderV1 indicator offers a high degree of customization, allowing traders to choose between multiple types of moving averages (SMA, EMA, WMA, and more) to suit their trading style. Additionally, users can set the number of candles required above or below the moving average “tunnel” to trigger buy or sell signals, providing flexibility to adapt to various market conditions and preferences. This versatility makes the indicator a powerful tool for fine-tuning trade entries and exits.

Copy the Code: PROPTRADERZ